In a previous post, we looked at Bonneville Power Administration’s deteriorating financial condition as it struggles with the effects of collapsing ecosystems, declining cash reserves, crushing debt, and rising costs for aging infrastructure amidst rapid changes in regional energy markets.

BPA receives no appropriations, and is required to cover expenses through revenues from electricity sales, transmission, and related services. The agency's busted budget suggests the need for further rate increases, but that would risk causing a “stampede to the exit”, as starkly described (Pg. 7) in a recent rate case filing by a group of their customers

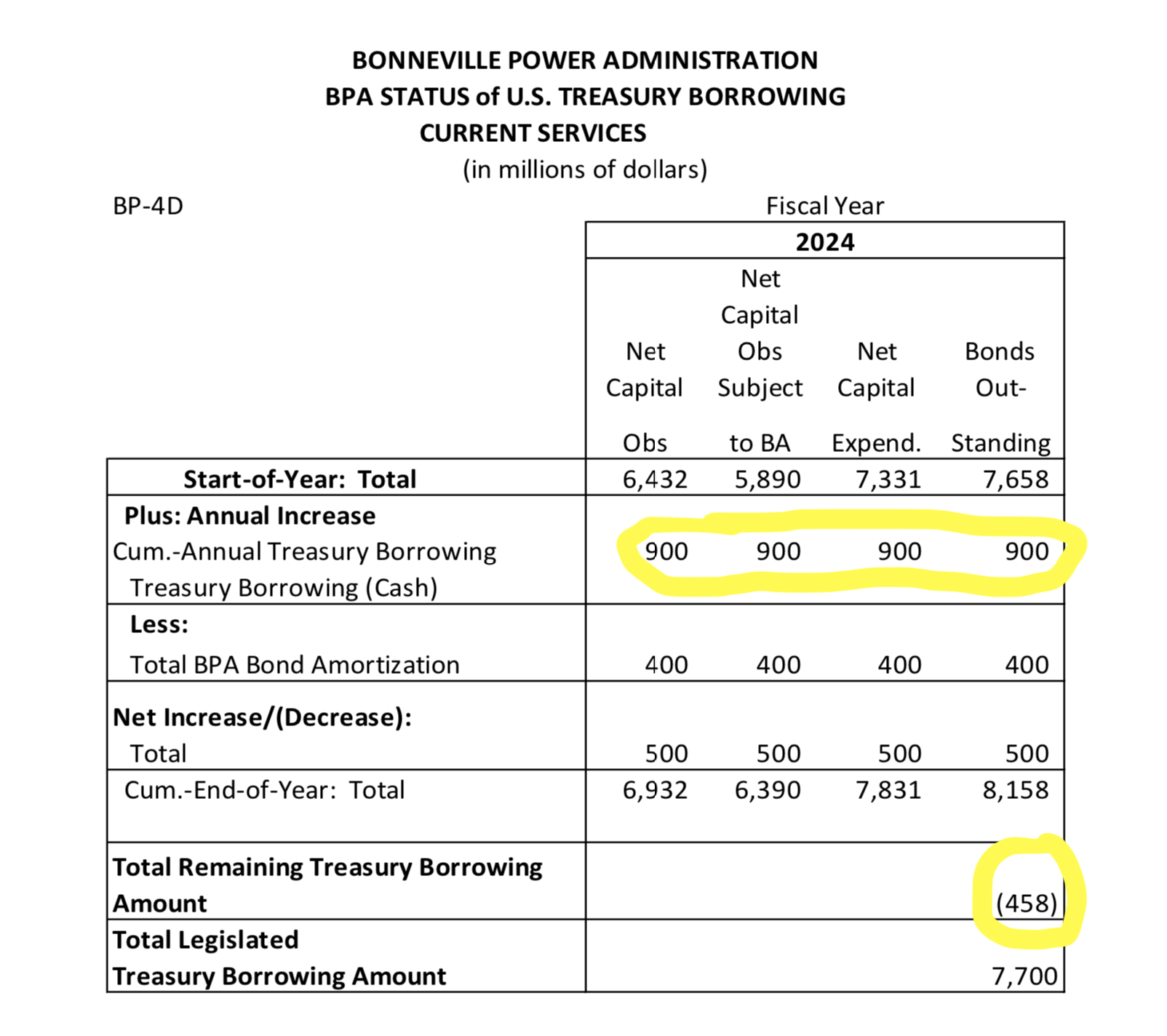

In order to keep rates steady, BPA borrows heavily against their $7.7B Treasury credit limit, itself a portion of their ~$17B of total debt. At current rates of borrowing, BPA will exceed their Treasury debt capacity in less than 4 years. Administrator Mainzer indicated in a March, 2018 discussion with the Northwest Power & Conservation Council that BPA would be looking for additional sources of financing:

"We are going to have to look for additional sources of capital financing…we are going to have to increase our debt capacity"

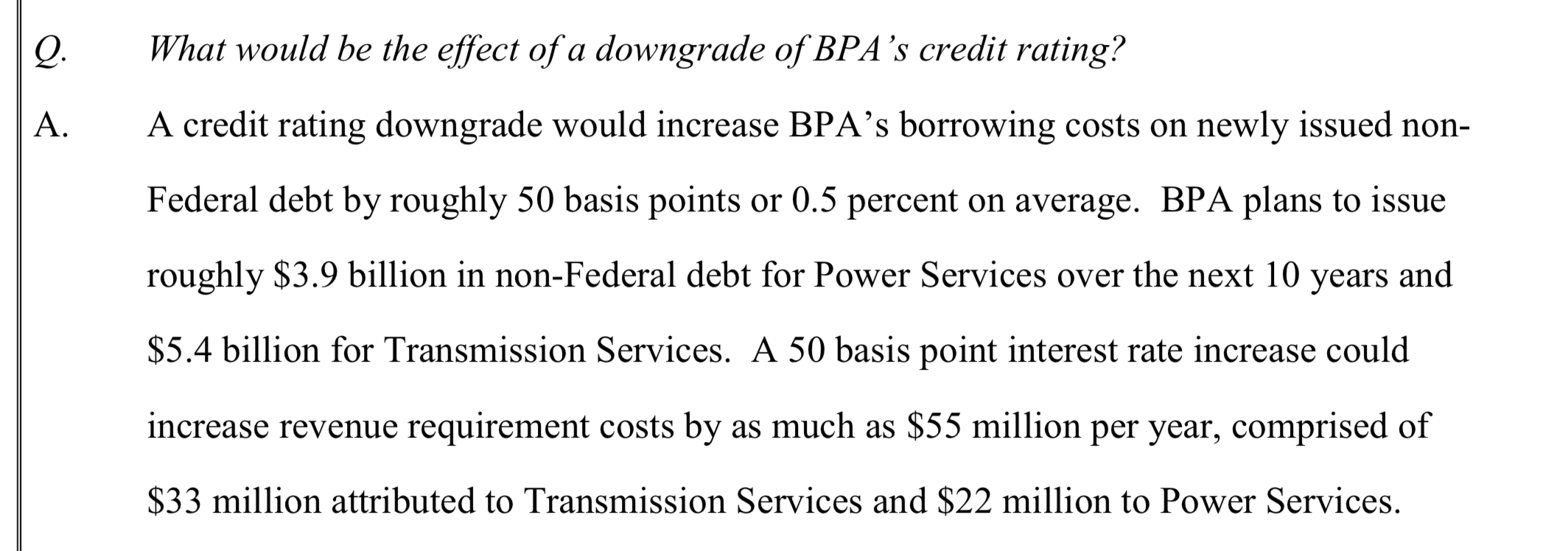

This makes credit ratings important - cost of capital has a big effect on such a levered business (Source: https://bit.ly/2HFWTLb pg. 17)

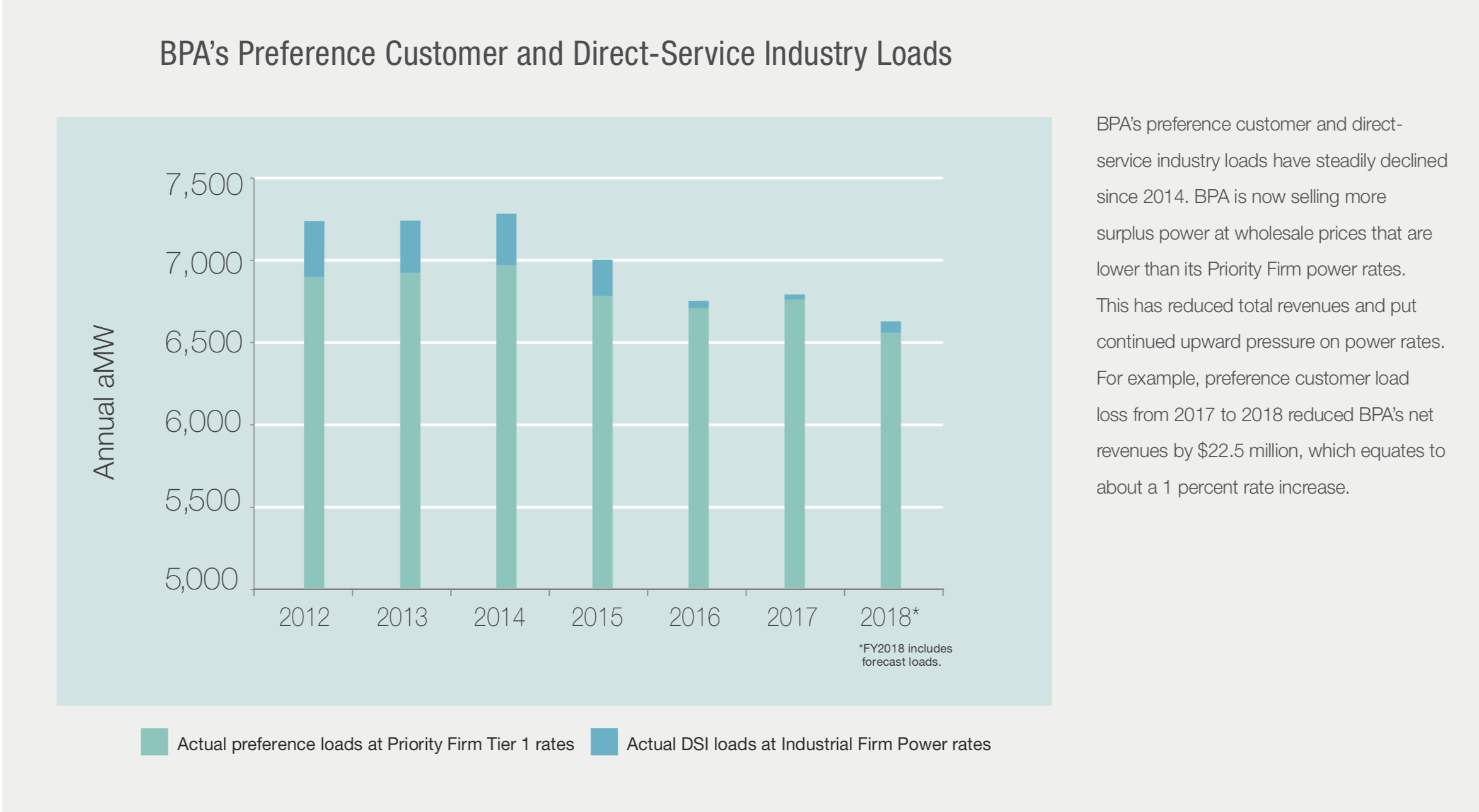

Such an increase in revenue requirements would prove problematic in the context of declining demand for, and value of, BPA’s abundant surplus power (Source: BPA 2018 Strategic Plan pg. 37)

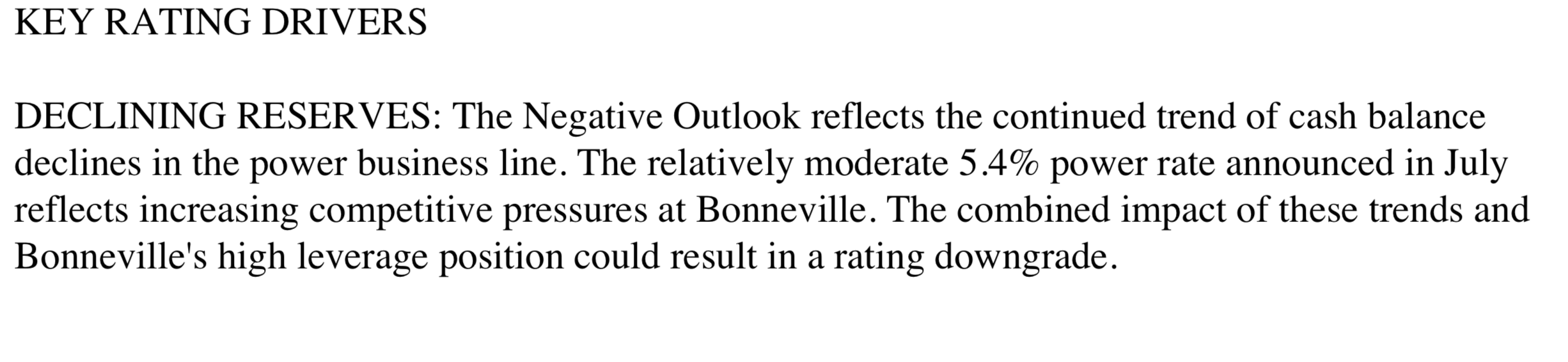

With increasing costs, decreasing revenues, and limited additional borrowing capacity, BPA is also spending down its cash reserves – burning about $900M in its Power business line over the last decade (Chart: Cowlitz PUD presentation)

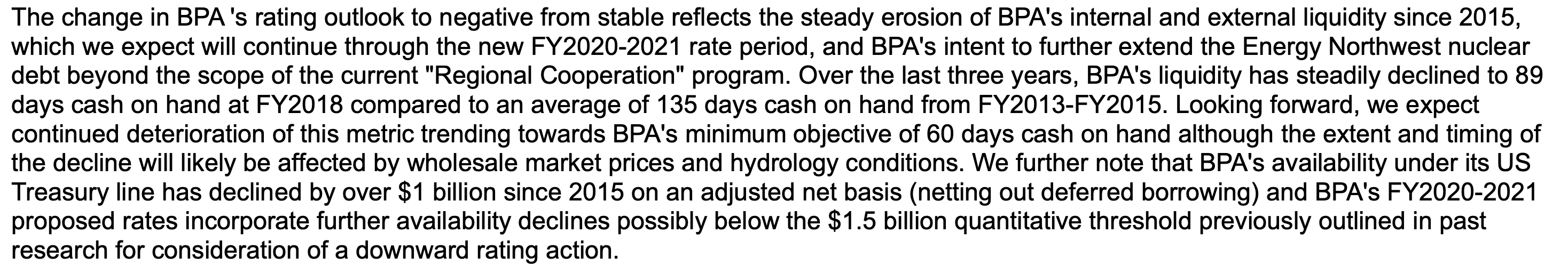

But those cash reserves are key metrics for the all-important credit ratings which affect BPA’s cost of capital. In fact, Fitch (2017) issued a negative outlook in part because of concerns regarding BPA's declining reserves, especially in Power Services (Source: https://bit.ly/2FhG5XW )

And in April, 2019, Moody’s also changed the rating outlook to negative from stable, citing the “steady erosion” of liquidity (Source: http://bit.ly/30g2jTl)

The industry average for financial reserves is 150-250 days (Source: https://bit.ly/2HFWTLb pg. 13 )

BPA has established a relatively modest threshold of 60 days cash on hand - $300M for Power Services, $100M for Transmission (Source: BPA Power Reserves Presentation)

To summarize: BPA needs to access capital, it needs that capital as inexpensive as possible, credit agency ratings are critical to borrowing rates, and cash reserves are a critical factor in those ratings.

In the spring of 2019, cash reserves in BPA’s Power line were depleted (near $0) when they need to be $300M, and cash reserves in BPA’s Transmission line were a little over $400M when they needed to be $100M. So…with imminent updates to Fitch and Moody's ratings, what’s a Power Marketing Authority to do?

Except reach back to 2002 and discover a $300M accounting error, the correction of which transfers $300M from Transmission to Power and allows BPA to avoid implementing a rate increase required by their Financial Reserves Policy but which would further unsettle their customers. BPA boasts about its transparency in disclosing an error that gets the agency out of its pinch. Problem solved! For now.

While it only makes sense for BPA to try and keep its cost of capital as low as possible, the challenges facing the organization are structural, not accounting.

BPA is currently burning cash and using Treasury borrowing in lieu of raising rates and increasing the risk of a “stampede to the exit”.

Recently, Idaho’s senior Congressman, Mike Simpson, called for a re-write of the Northwest Power Act, the 40-year old instructions governing the relationship between BPA, the Federal Columbia River Power System, and fish and wildlife programs. It is imperative that the PNW engage in the discussion about what role we want BPA to serve in the future - a managed restructuring would be better than a crisis.