Bonneville Power Administration (BPA), a division of the Department of Energy, markets power from 31 dams constructed by the federal government as well as one nonfederal nuclear plant. BPA was a New Deal response to the challenges of rural electrification in the mid-1930s, when less than one-third of Pacific Northwest farmers connected to the grid. The dams are operated in partnership with the Army Corps of Engineers and the Bureau of Reclamation, and BPA's mandate includes covering its costs through electricity sales and related services to about 140 Public Utility District (PUD), municipal, cooperative, and other customers under long-term contracts. BPA’s two primary business lines are Power and Transmission Services.

For 80 years, BPA has loomed over the Pacific Northwest's energy and ecology. BPA currently provides over 25% of the region's generated electric power, operates 75% of our high-voltage transmission lines, and funds selective mitigation of the Columbia River basin hydropower system's effects on fish and wildlife - what is now the most expensive ecological recovery project in U.S. history, with no resolution in sight.

Throughout BPA's history, regional stakeholders have challenged specific rate-setting policies or species recovery plans. And several federal administrations, citing dramatic differences in present markets relative to the early 1900s, floated the idea of privatizing all or parts of BPA's business. But there has never been a sustained re-consideration of Bonneville's role in delivering a future of abundance - restored fisheries, a clean and resilient electrical grid, and distributed economic opportunities.

That conversation is happening now. BPA’s financial condition is challenged by rising operation and maintenance costs at the aged dams, payments on $15 billion of debt, declining cash reserves, and plunging prices for wind and solar electricity. Several of the public utilities are reconsidering their long-term contracts for BPA’s power as the government-run, centralized generation and transmission business model seems uncertain.

BPA identifies itself as “the engine of the Pacific Northwest’s economic prosperity and environmental sustainability…” citing “low rates, environmental stewardship, and regional accountability” as metrics for success. Beginning with an overview of BPA's current position in the regional energy landscape, an ongoing series of posts will look at each of these claims in the context of regional economies, transformations in the energy sector, and our understanding of Columbia River ecosystems.

The Pacific Northwest is awash in energy, with ~4,000aMWs of surplus. BPA expects a surplus through at least 2028, even in critical water years. Normal water flows will produce larger surpluses (Source: BPA 2017 White Book)

This annual surplus has seasonal variability, spiking from April through June as Columbia River basin flows increase through the spring, and dropping to net demand during low water from December to March. This variability has implications for specific hydro assets managed by BPA, which must curtail and/or sell surplus power some of the year while procuring power from regional markets other times of the year.

(Source: BPA 2017 White Book)

Against this backdrop of annual PNW Regional Surplus and its specific seasonal character, west coast energy markets have changed dramatically in the last 10 years, affecting not only overall demand for surplus Columbia River hydropower but daily profitability - a fundamental restructuring of the market.

BPA used to sell most of its surplus power to California. As substantial amounts of solar, wind, and conservation have come online, BPA can only sell its $37/MWh surplus power for a profit from about 6pm-12am and for a few hours in the morning. Many hours of many days, BPA loses money on the surplus power it sells. (Chart source: U.S. Energy Information Association)

Investments in efficiency have kept regional demand basically flat over the same time profitability has deteriorated.

(Source: BPA 2018 Strategic Plan pg. 37)

and costs for Operations and Maintenance (O&M) of an aging fleet of dams are increasing…

(Source: Cowlitz PUD presentation)

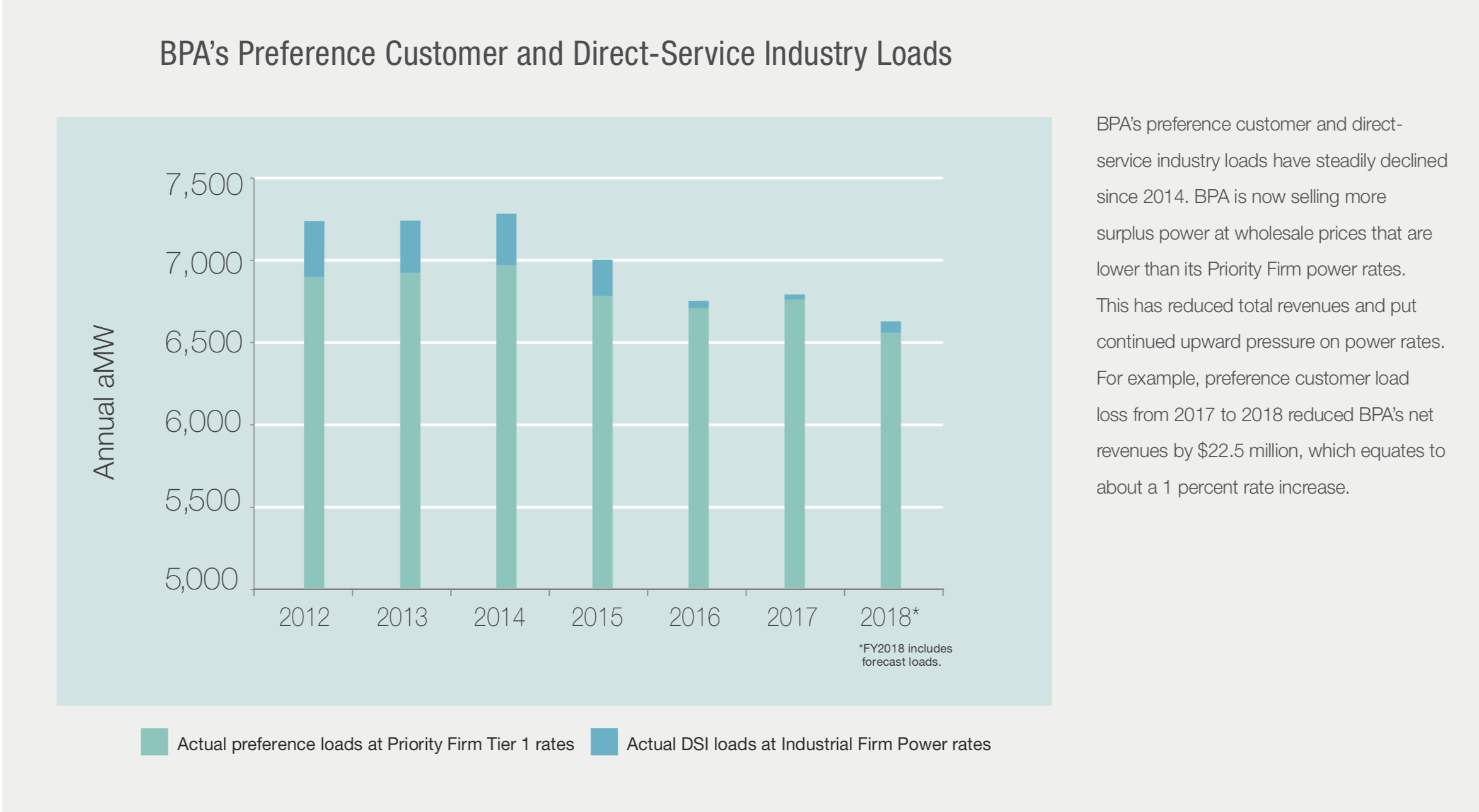

…which is being reflected in rate increases for their customers (30% in the last 10 years). BPA Rates are now significantly higher than “market” rates and the spread is expected to widen as the price of wind, solar, and storage continues to plunge. BPA Administrator Elliot Mainzer has acknowledged these conditions and (under)stated that further widening would be a problem.

(Video source: Northwest Power and Conservation Council, March, 2018; chart source: BPA 2018 Strategic Plan pg. 35)

BPA has summarized their challenging position in the market (Source: BPA 2018 Strategic Plan pg. 34 )

BPA customers cannot quickly pivot to benefit from other suppliers and cheaper rates because they signed 20-year contracts to purchase BPA power through 2028. Several PUDs have already expressed concern about the lack of competitiveness of BPA’s rates and indicated they might look elsewhere when contracts expire. BPA Administrator Elliot Mainzer discusses potential customer loss with NPCC (Video source: NPCC)

Customers such as Cowlitz PUD are affirming this potential, as in this presentation to NPCC

(Source: Cowlitz PUD presentation)

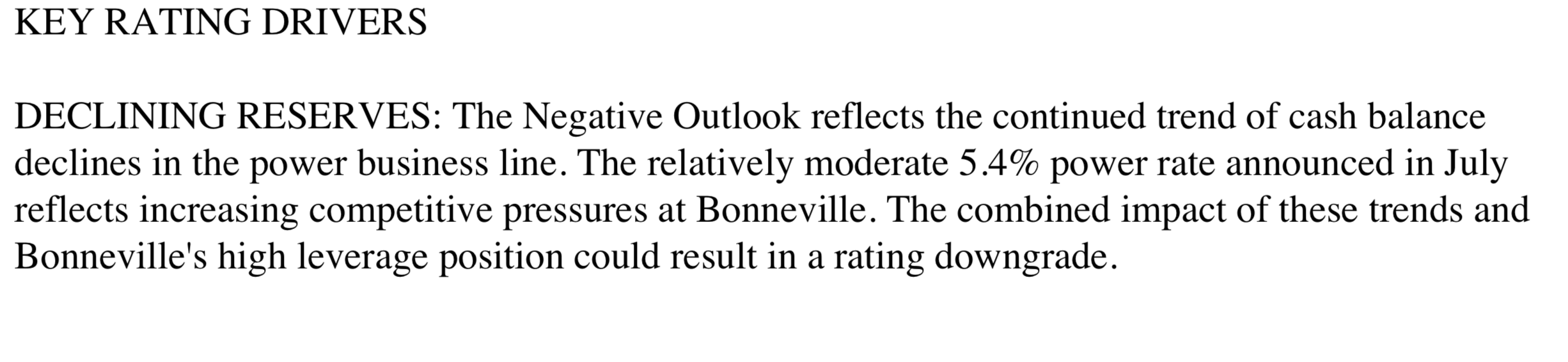

Losing even a single PUD would exacerbate BPA’s problems, spreading increasing costs over even fewer customers. They cannot afford this. BPA's Power Services debt to asset ratio is 99%, very high compared to the average for the utility industry (54%).

BPA’s Power Services cash reserves are down to near zero and they have set a modest goal of improving liquidity in the Power Services business line to 60 days cash-on-hand (industry average is 270 days). BPA’s requested rate increase budgeted $20M/year set aside for this goal, which would be reached in 15 years at the implied rate. Over the last decade, BPA has burned through about $800M in cash (Chart: Cowlitz PUD presentation)

One credit rating agency (Fitch) has downgraded their outlook to “Negative”, citing loss of reserves, high debt (Source: Fitch)

Based on projections from BPA’s most recent rate filing, its borrowing capacity from the U.S. Treasury will be depleted by 2022, coincident with the need for substantial investment in turbine replacement at some of the dams, putting BPA’s future capital program at risk. In March, 2018, BPA Administrator Elliot Mainzer said "We are going to have to look for additional sources of capital financing... We are going to have to increase our debt capacity".

(Chart: BPA 2019 Congressional Budget pg. 78)

BPA's competitive position is uncertain, at best. Heavily indebted and dependent on more borrowing going forward, BPA isn't marketing power at true cost, exposing customers and the region to financial risk. Slow to respond to energy market transformations, BPA hasn't transparently and comprehensively conducted an assessment of the economic viability of its generating assets. At the same time, BPA curtails energy innovation in the region through its inherent conflict, marketing expensive power from dams and a nuclear plant while also managing transmission interconnection for competing private sector renewable energy projects. As of January, 2019, over 15,000MW of wind, solar, and storage sat on BPA's Interconnection Queue, an increase of about 40% from only 6 months prior.

There is no doubt that Bonneville Power - public power, more broadly - played a critical role in electrifying the rural Pacific Northwest and catalyzed regional economic growth in the mid-1900s. There is also no doubt that times have changed.

A combination of the unequivocal absence of progress towards salmon recovery and the urgent need to upgrade our electrical grid offers an unprecedented opportunity to compare past promises, present realities, and future alternatives along the Columbia.